In accordance with the risk control requirements of customer due diligence of financial institutions, data is collected intelligently through big data, artificial intelligence and other technical means, AIGC automatically analyzes, conducts comprehensive and in-depth investigation and analysis of credit enterprises, and automatically generates due diligence reports.

Business Challenges

-

Low efficiency of offline operation

Low efficiency of offline operationOffline access to financial, flow data, data cleaning workload, heavy work, error-prone, high operational risk.

-

Large risk of information dispersion

Large risk of information dispersionThe customer's situation is not fully understood, the potential risk is difficult to investigate, the data is difficult to multi-dimensional verification, not easy to accurately verify.

-

Limited means and Difficult to operate

Limited means and Difficult to operateOffline operations take a long time to fill in forms and are prone to errors; It is necessary to manually query a large amount of information, which is easy to miss and difficult to handle business at any time due to space constraints.

-

Experience is difficult to standardize

Experience is difficult to standardizeThe degree of risk identification of credit review personnel is different, and there are large differences in material collection, information collection, personnel inquiries and other contents of the due diligence process, which is difficult to standardize.

Precipitation of public and micro-due diligence business experience, Ping An Group's knowledge map, to meet the financial institutions due diligence scenario of digital solutions.

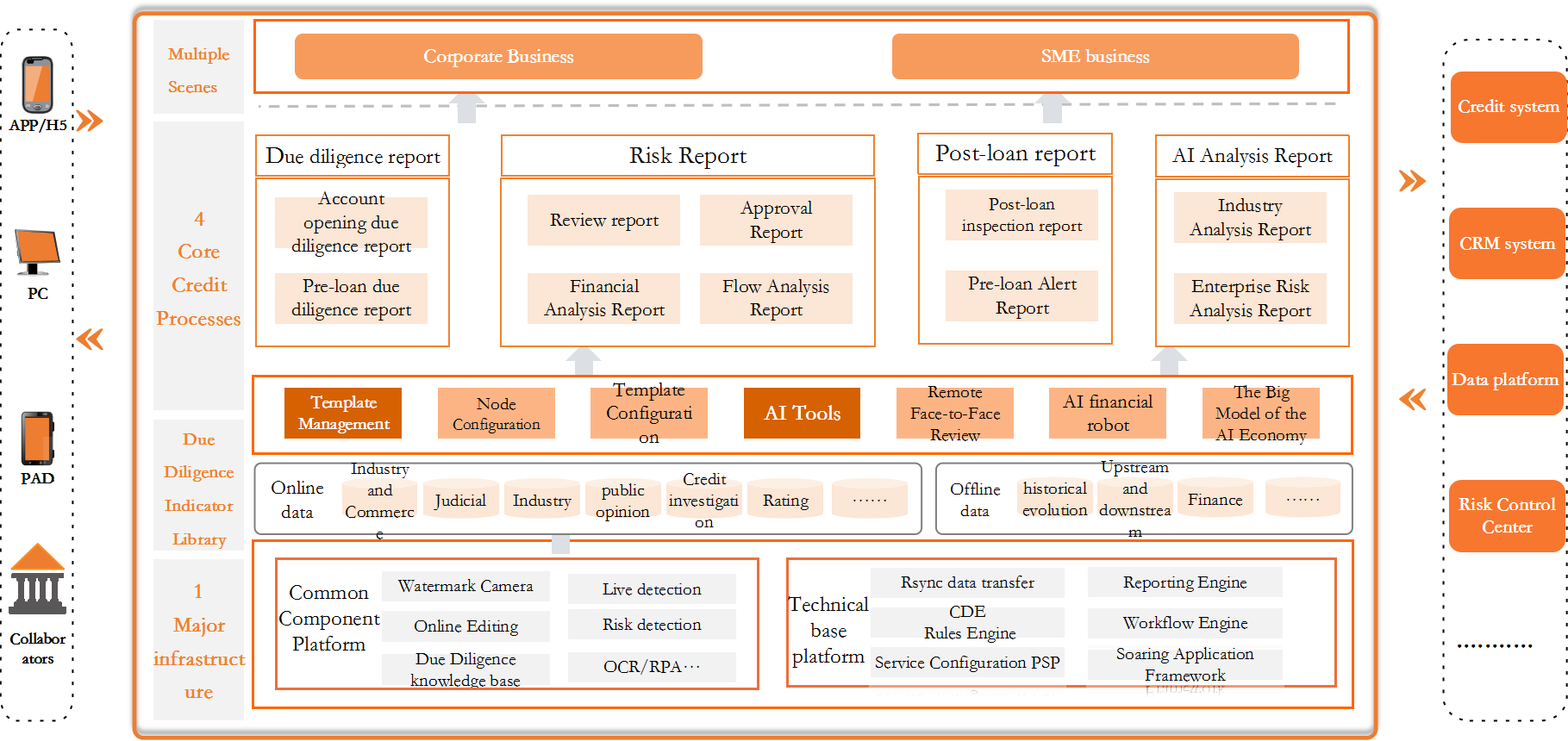

Smart due diligence business architecture:

1 major infrastructure, supporting 4 core processes, and meeting N core scenarios

Product Strengths

-

Business experience precipitation

Business experience precipitationThe system precipitates experience in various scenarios, integrates Ping An's advanced large model analysis, and has been verified by a number of financial institutions.

-

Intelligent data collection

Intelligent data collectionConnect with big data such as industry and commerce, justice, people's bank of China, public opinion, etc. to automatically obtain data. Intelligent means such as OCR and RPA assist customer managers to quickly obtain due diligence data and automatically fill in due diligence reports to reduce entry time.

-

AI intelligent analysis

AI intelligent analysisGenAI automatically generates intelligent risk analysis reports to assist account managers in quickly identifying business risks, financial risks, public opinion risks, etc.

-

Remote video due diligence

Remote video due diligenceThrough AI video technology, the borrowing enterprises are adjusted remotely, the identity is verified online, the content is recorded and recorded, and the cost is saved.

-

One-click generation of due diligence report

One-click generation of due diligence reportAfter the account manager completes the due diligence report, the system risk detection tool automatically verifies the completeness of the due diligence report and automatically generates the due diligence report.

-

Report flexible assembly and adaptation

Report flexible assembly and adaptationAccording to business experience, the chapters of the due diligence template are disassembled to form 2000 chapters, which can be assembled according to the requirements of financial institutions to adapt to the due diligence requirements of various scenarios before, during and after lending, and can support the dual deployment of mobile and PC terminals.

Customer Cases

-

The intelligent due diligence project of a head city commercial bank

The intelligent due diligence project of a head city commercial bankThe intelligent due diligence project of a head city commercial bank covers the requirements of intelligent due diligence in the whole process of account opening, pre-loan and post-loan, and covers the whole bank's public and inclusive credit products. Effect improvement:

Product diversification: 12 major public products;

Modular reporting: 500+;

Automation to improve efficiency: 50%.

- Solution Overview

- Business Challenges

- Product Solutions

- Product Strengths

- Customer Cases

Does this page meet your needs?

-

Yes

-

No

Your recognition and praise will motivate us to better improve the website experience